Virginia Market

- No enabling legislation to allow the private market to participate in community solar

- Pent-up demand for solar in Virginia is creating a specific demand for community solar

- Community solar options are being pursued by cooperatives and investor owned utilities at various levels

- Absence of a competitive market will not allow best pricing for consumers of these utility owned options

DC Market

- Final of regulations for Community Renewable Energy Act

- Rooftop leases

- Low income segment not being adequately served through standard on-premises installations

- Virginia Status

VIRGINIA MARKET

No enabling legislation allowing the private market to participate in community solar

- Community solar legislation has been pursued in the General Assembly every year since 2011

- Agricultural net metering was passed in 2013 and a few projects are underway

- Both investor owned utilities and cooperatives have expressed concern regarding…

- Pricing required to create a market for community solar without an in state SREC market or other incentive

- Non-participants subsidizing participants

- Billing mechanism

- Loss of distribution and transmission revenue

Pent-up demand for solar in Virginia is creating a specific demand for community solar

- Without any incentives, economies of scale through community solar can provide substantially lower costs than residential rooftop installations.

- Solarize programs throughout the state have created a market eager for solar.

- Utilities are seeing demand from members and/or customers and are responding.

- In the absence of enabling legislation for the private sector, there will be no competitive market for community solar services.

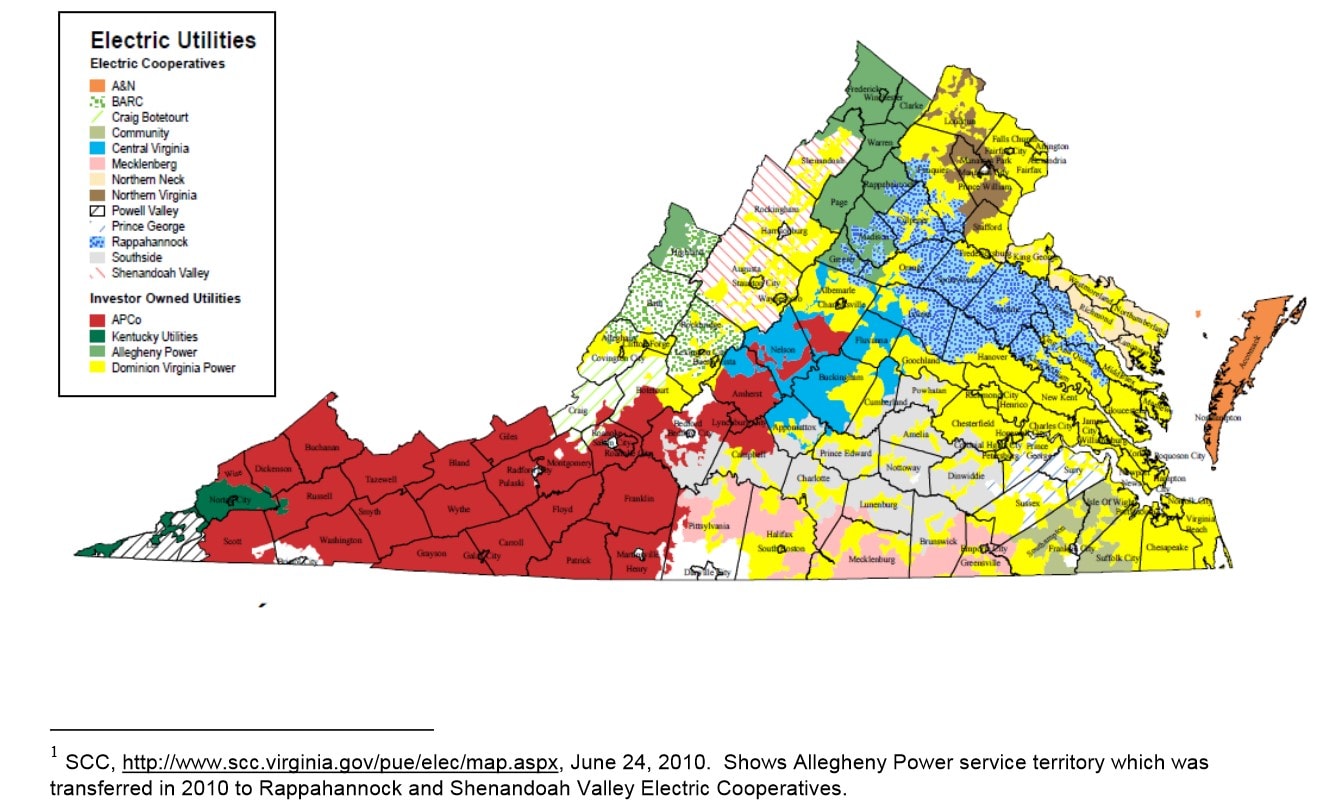

Virginia’s Electric Providers

- Electricity is provided to retail electric customers by:

- Three investor-owned utilities providing 84.2 percent of retail sales;

- Thirteen electric cooperatives providing 11.3 percent of retail sales; nine of the cooperatives purchase power from and are members of ODEC

- Eight municipal utilities providing 4.5 percent of retail sales.

- Investor-owned electric utilities include:

- Dominion Virginia Power;

- Appalachian Power (American Electric Power); and

- Old Dominion Power (Kentucky Utilities).

- The 16 municipal electric utilities, serving customers located in their localities, include:

- The Cities of Bedford, Bristol, Danville, Franklin, Harrisonburg, Manassas, Martinsville, Radford, and Salem; The Towns of Blackstone, Culpeper, Elkton, Front Royal, Richlands, and Wakefield; and Virginia Tech (serving the Town of Blacksburg).

Virginia projects in development

BARC – 500 kW

- BARC will build (through a solar EPC contractor), own and maintain a large solar array on behalf of customers who subscribe to the output.

- Funded in part by a grant of $500,000 from the Appalachian Regional Commission and a grant of $250,000 from the United States Department of Agriculture.

- Customers have no upfront capital costs and no maintenance responsibilities, while still enjoying all the benefits of solar as if it were sitting on their rooftops.

- On a first-come, first-served basis, we will offer “solar subscriptions” to the facility’s output, enabling customers to take up to 25% of their annual average energy consumption from the project – at a rate that is fixed for many years

- If the project oversubscribes before it is built, we will run a lottery and maintain a waiting list for future system expansion.

- Pricing not established.

ODEC – 30 MW

- RFP issue in July for a total of up to 10 MW of PV based solar power from projects ranging in size from approximately 1 MW up to 10 MW.

- Power purchase agreements should have a minimum term of ten (10) years and a maximum term of twenty.

- ODEC may wish to utilize any solar facility with which it has contracted as a component of a community solar project with one or more of its members.

- ODEC has awarded two contracts totaling 30 MWs.

- Community solar options to member cooperatives and pricing has not been established.

Dominion Virginia Power – 2 MW DCS Rider

- Qualifying customers may purchase electric energy from a 2 MW Dominion-owned solar facility located in Virginia.

- Facility to be constructed under blanket CPCN granted to Dominion for the Solar Partnership Program.

- Allow Dominion to gather information about the appeal of a subscription based solar model.

- Proposed as an alternate to net energy metering, although not replacing.

- 100 kWh blocks solar at $4 per block, or 4 cents per kWh in addition to customer’s bill.

- Cost for program is determined by taking the cost of the energy ($0.141/kWh), then subtracting certain credits to lower the cost for participating customers. These credits are for capacity value ($0.004/kWh), value of energy ($0.046/kWh), and SRECs ($0.051/kWh).

- Cost of the power ($0.141/kWh) is determined using a regulated cost of service methodology (EPC costs are estimated at $2.10/watt) which is then converted to levelized cost per kWh.

Recommendations for Virginia

Investor Owned Utilities

- Pilot community solar is promising although at a 4 cent per kWh premium above retail this is not a true option to net energy metering.

- Credit rates for community solar should be established that provide full value for solar energy and its attributes while ensuring that program subscribers bear all incremental program costs.

- Private industry should be allowed to develop projects as well to determine a true market index for this product offering.

- SREC pricing that accurately reflects the market should be used to avoid unrealistic expectations of subscribers.

Cooperatives

- Continue education of members regarding the benefits of solar and community solar.

- Listen to members and their request for community solar offerings.

- Engage the assistance of the private sector to create these programs at lowest cost to members.

- Fair credit rates for community solar.

DC MARKET

Issues to address

- Finalization of regulations for Community Renewable Energy Act

- Distribution charge not included in credit rate.

- Real estate is a premium, therefore rooftop leases will be required to satisfy demand.

- Local and Federal Governments have not been will to open rooftops for private development.

- Commercial property owners are averse to entering into long term rooftop leases.

- Minimal returns when compared to risks

- Uncertainty regarding future use of rooftop space

- Impact on property value

- Roof warranty issue

- Roof replacement costs

- Despite the efforts of the DC SEU the low-income segment is continuing to be underserved in the DC market with regards to solar energy. A larger proportion of low-income residents in DC are not eligible for installations on their homes.

Recommendations for DC

- Governments should establish long term programs with scheduled release of rooftop space.

- Education for commercial property owners regarding risks, cost, and benefits of community solar.

- Incentives to commercial property owners to create market for rooftop leases.

- Community solar incentive specifically for low-income market segment.

Leave A Comment